• Order intake rises to € 1,248.7 million (+59%; previous year: € 784.0 million)

• Sales revenues increase to € 933.5 million (+11%; previous year: € 838.0 million)

• EBIT improves to € 42.2 million (+27%; previous year: € 33.2 million)

• EBIT margin of 4.5% above previous year (4.0%)

• Free cash flow climbs to record level of € 113.2 million (+242%; previous year: € -79.7 million)

Bielefeld // DMG MORI AKTIENGESELLSCHAFT recorded a highly dynamic business development in the 1st half year of 2021. All key figures increased significantly: Order intake rose by +59% to € 1,248.7 million (previous year: € 784.0 million). Sales revenues increased to € 933.5 million (+11%; previous year: € 838.0 million). The earnings situation also improved further: EBIT rose to € 42.2 million (+27%; previous year: € 33.2 million). The EBIT margin reached 4.5% (previous year: 4.0%). Free cash flow in particular developed positively, rising to the record value of € 113.2 million at the end of the first half year (+242%; previous year: € -79.7 million).

Chairman of the Executive Board Christian Thönes: “The current business development reflects our performance last year: We have come out of the crisis well and, in addition to new production plants in China and Egypt, with PAYZR we are implementing a new digital subscription business model. DMG MORI has become even more innovative, digital and resilient. For 2021, we are confident and raise our forecast again.”

Order intake // Demand continues to rise in almost all industries

Global demand for machine tools continued to grow in almost all industries in the 2nd quarter. DMG MORI recorded a notable rise in order intake of +92% (previous year: € 343.8 million). In particular, new machine business increased significantly by +105%. Overall, orders rose to € 658.9 million and in the core business with machine tools and services were even +11% above the high pre-corona-level of 2019 (€ 595.1 million).

In the 1st half year, order intake increased by +59% to € 1,248.7 million (previous year: € 784.0 million). Domestic orders rose to € 382.4 million (+73%; previous year: € 220.5 million). International orders increased to € 866.3 million (+54%; previous year: € 563.5 million). The share of international orders thus amounted to 69% (previous year: 72%).

Strong increase in the 2nd quarter: DMG MORI AKTIENGESELLSCHAFT recorded a highly dynamic business development in the 1st half year of 2021. All key figures increased significantly. Chairman of the Executive Board Christian Thönes (right) as well as Executive Board members Björn Biermann (middle) and Michael Horn are looking to the future with confidence and are again raising the forecast for 2021.

Sales revenues // Good order situation reflected in sales revenues

In the 2nd quarter, sales revenues of € 511.9 million were significantly higher than in the previous year (+35%; € 380.0 million). In the 1st half year, sales revenues reached € 933.5 million (+11%; previous year: € 838.0 million). The increase is due to the generally good order situation in the new machine business. Service and spare parts business was impacted by the continuing travel restrictions. Domestic sales revenues were € 299.4 million (previous year: € 270.0 million). International sales revenues amounted to € 634.1 million (previous year: € 568.0 million). As in the previous year, the export share was 68%.

Results of operations, financial position and net worth // Free cash flow rises to record level

The earnings situation improved further – with high growth rates in the 2nd quarter in particular: EBITDA rose to € 46.5 million (previous year: € 24.8 million). EBIT increased to € 30.4 million (previous year: € 7.9 million). The EBIT margin improved to 5.9% (previous year: 2.1%). EBT amounted to € 29.1 million (previous year: € 7.4 million). EAT was € 20.3 million (previous year: € 5.2 million).

In the 1st half year, EBITDA reached € 74.2 million (previous year: € 68.0 million). EBIT rose to € 42.2 million (previous year: € 33.2 million). The EBIT margin reached 4.5% (previous year: 4.0%). EBT amounted to € 40.6 million (previous year: € 32.2 million). The group reported EAT of € 28.3 million as of 30 June 2021 (previous year: € 22.4 million).

The financial position also developed positively: free cash flow was clearly positive in the 2nd quarter at € 73.6 million (+271%; previous year: € -43.0 million). In the 1st half year, free cash flow rose to the record value of € 113.2 million (+242%; previous year: € -79.7 million).

Employees // Stable foundation and a strong team

At 30 June 2021, the group had 6,693 employees, including 225 trainees (31 Dec. 2020: 6,672). Personnel costs amounted to € 262.3 million (previous year: € 253.3 million). The personnel quota improved to 27.2% (previous year: 29.4%).

Research and Development // With PAYZR to the “Netflix for Manufacturing”

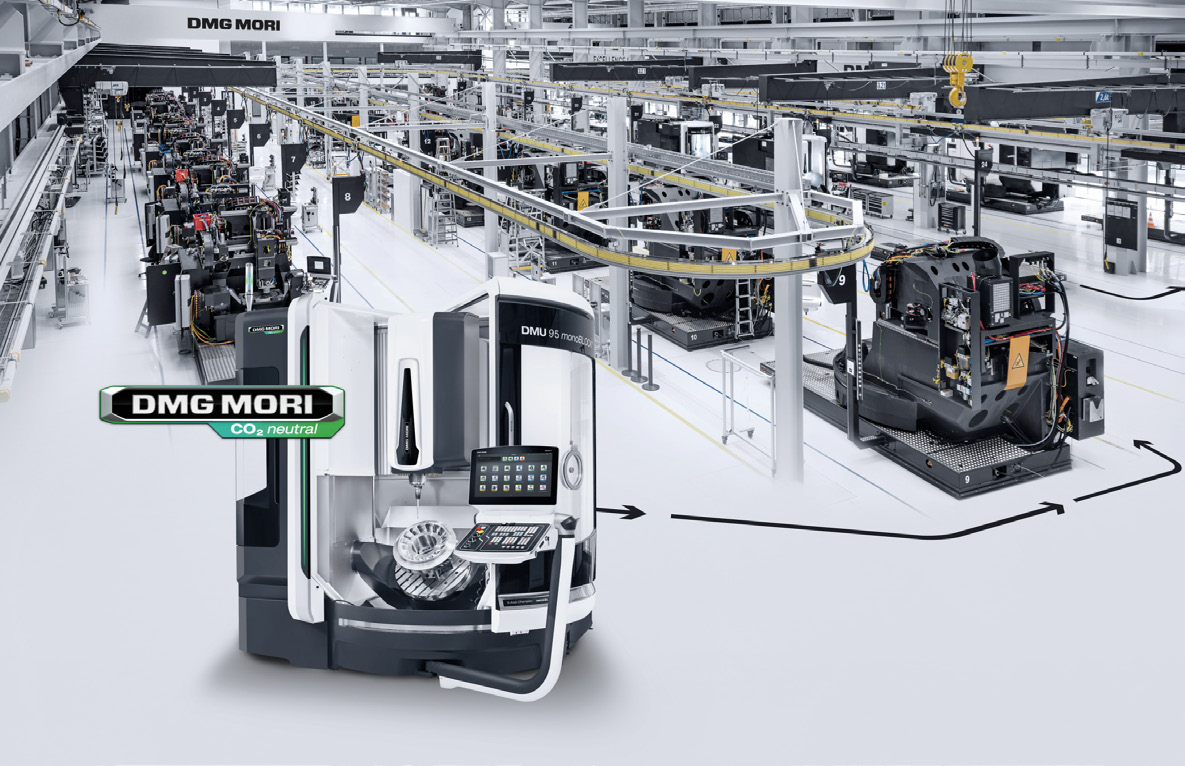

High-precision machine tools and technologies from DMG MORI are at the beginning of global value chains. Our 155 different machine models as well as 54 automation solutions are high-tech instruments and a guarantee for progress. In the financial year 2021, we present 46 innovations together with DMG MORI COMPANY LIMITED – including 11 world premieres, 5 automation solutions, 23 digital innovations and 7 new DMG MORI Components.

With PAYZR for Equipment-as-a-Service and Software-as-a-Service, we are implementing a new, digital subscription business model. For our customers, this means fast innovation cycles without risk – with maximum flexibility, cost and price transparency and thus maximum planning security. Subscription & All-In instead of investment and purchase. With PAYZR – PAY with Zero Risk – DMG MORI becomes the “Netflix for Manufacturing”. The digital point-of-sale for all PAYZR offers is the new “DMG MORI Store powered by ADAMOS”.

In addition to automation and digitization, the focus remains on sustainability. Already since May 2020 DMG MORI has a CO2-neutral “Company Carbon Footprint”. Since January 2021, DMG MORI has also been one of the first industrial companies to have a climate-neutral “Product Carbon Footprint”. This means that all machines delivered worldwide are completely climate-neutral along the entire value chain – from raw material to delivery.

Outlook 2021 // Confidence and tailwind – forecast raised again

The overall economy and the global market for machine tools are on the road to recovery. According to the April forecast of the VDW and British economic research institute Oxford Economics, global consumption is expected to increase by +15.2% to € 66.6 billion in 2021. The next association forecast will be published in October. Nevertheless, 2021 remains challenging. Rising raw material prices and transport costs as well as more difficult providing of material within the supply chain are affecting the market recovery.

At DMG MORI, we feel confidence and tailwind. Our strategic fit of automation, digitization and sustainability is more suitable than ever. We expect demand to continue to improve – provided there will still be no significant effects from corona mutations. Based on the good performance in the first half year, we are once again raising our forecast for 2021: For the full year we now plan order intake of around € 2.25 billion (previously: around € 2.0 billion). Sales revenues are now expected to be around € 1.95 billion (previously: around € 1.8 billion). We currently estimate EBIT of around € 100 million (previously: around € 60 million). Free cash flow is expected to be around € 140 million (previously: around € 70 million).

In short: DMG MORI is well positioned. Our broad machine and automation portfolio is unique in the industry. With our global footprint, far-reaching service offerings and digitization solutions, we provide everything integrated, end-to-end and sustainable from a single source – worldwide!

DMG MORI AKTIENGESELLSCHAFT

The Executive Board

Company Profile // DMG MORI

DMG MORI AKTIENGESELLSCHAFT is a worldwide leading manufacturer of machine tools with sales revenues of more than € 1.8 billion and around 6,700 employees. Together with DMG MORI COMPANY LIMITED, our sales revenues are around € 2.7 billion. Around 12,000 employees work for the “Global One Company”. With 138 sales and service locations – including 15 production plants – we are present worldwide and deliver to more than 100,000 customers from 54 industries in 86 countries.

Our integrated automation and end-to-end digitization solutions enrich the company’s core business with turning and milling machines, Advanced Technologies (Ultrasonic, Lasertec) and Additive Manufacturing. Our modular products allow quick, easy and scalable access to digital manufacturing and integrated digitization along the entire process chain – from planning and preparatory work to production and monitoring to service. Our mission: Empower our customers in manufacturing and digitization.

Our technology excellence is bundled within the main sectors of Aerospace and Automotive as well as Semiconductor, Medical, Die & Mold. The partner program DMG MORI Qualified Products (DMQP) allows us to offer perfectly matched peripheral products from a single source. Our customer-focused services covering the entire life cycle of a machine tool include training, repair, maintenance and spare parts service. The online customer portal “my DMG MORI” digitizes all service processes.

Already since May 2020 DMG MORI AKTIENGESELLSCHAFT has an equalized CO2 balance (Company Carbon Footprint). All machines delivered since January 2021 are produced worldwide – along the entire value chain – completely CO2-neutral (Product Carbon Footprint).

* * *

There are two companies using the name “DMG MORI”: DMG MORI AKTIENGESELL-SCHAFT with registered office in Bielefeld, Germany, and DMG MORI COMPANY LIMITED with registered office in Nara, Japan. DMG MORI AKTIENGESELLSCHAFT is (indirectly) controlled by DMG MORI COMPANY LIMITED. This release refers exclusively to DMG MORI AKTIENGESELLSCHAFT. If reference is made in this release to “DMG MORI“, this refers exclusively to DMG MORI AKTIENGESELLSCHAFT and its controlled companies within the meaning of Section 17 of the German Stock Corporation Act (Aktiengesetz – AktG). If reference is made to “Global One Company”, this refers to the joint activities of DMG MORI COMPANY LIMITED and DMG MORI AKTIENGESELL-SCHAFT including all subsidiary companies.